Long Term Care Insurance, Power of Attorney, Wealth Management, and Other Firsts

As we age, it is important to start thinking about our future needs. This includes planning for our financial well-being, our health care, and our end-of-life wishes.

One of the most important things you can do is to make sure you have adequate long term care insurance. This type of insurance can help you pay for the costs of long-term care, such as nursing home care or assisted living.

Another important document to have in place is a power of attorney. This document gives someone else the legal authority to make decisions on your behalf if you are unable to do so yourself.

4 out of 5

| Language | : | English |

| File size | : | 3647 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 87 pages |

| Lending | : | Enabled |

Wealth management is also an important part of planning for your future. This involves managing your investments, retirement savings, and other financial assets.

Finally, it is also important to think about your end-of-life wishes. This includes making decisions about your funeral arrangements, organ donation, and other end-of-life care.

Planning for your future can be overwhelming, but it is important to start thinking about these things early on. By ng so, you can ensure that you have the necessary resources in place to meet your needs as you age.

Long term care insurance is a type of insurance that can help you pay for the costs of long-term care, such as nursing home care or assisted living. This type of insurance is becoming increasingly important as the population ages and more people are living longer.

There are a number of different types of long term care insurance policies available. Some policies cover only nursing home care, while others cover a wider range of services, such as assisted living, home health care, and adult day care.

The cost of long term care insurance varies depending on a number of factors, including your age, health, and the type of policy you choose. However, the average annual premium for a long term care insurance policy is around $2,500.

If you are considering purchasing long term care insurance, it is important to compare policies from different insurers. You should also make sure you understand the coverage and limitations of each policy before you Free Download it.

A power of attorney is a legal document that gives someone else the legal authority to make decisions on your behalf if you are unable to do so yourself. This document can be used for a variety of purposes, such as managing your finances, making medical decisions, and selling your property.

There are two main types of power of attorney:

- General power of attorney: This type of power of attorney gives the agent broad authority to make decisions on your behalf.

- Limited power of attorney: This type of power of attorney gives the agent only specific powers, such as the power to manage your finances or make medical decisions.

It is important to choose someone you trust to be your agent. This person should be someone who is responsible, organized, and has your best interests at heart.

Once you have chosen an agent, you should have a power of attorney document drafted by an attorney. The document should clearly state the powers that you are granting to your agent and the circumstances under which the power of attorney will become effective.

Wealth management is the process of managing your investments, retirement savings, and other financial assets. This involves making decisions about how to allocate your assets, how to invest your money, and how to plan for your retirement.

Wealth management is an important part of planning for your future. By making wise financial decisions, you can ensure that you have the resources you need to live a comfortable and secure retirement.

If you are not comfortable managing your own finances, you can hire a wealth manager to help you. A wealth manager can provide you with personalized investment advice and help you create a financial plan that meets your specific needs.

It is also important to think about your end-of-life wishes. This includes making decisions about your funeral arrangements, organ donation, and other end-of-life care.

Talking about your end-of-life wishes can be difficult, but it is important to do so. By making your wishes known, you can ensure that your loved ones know what you want and that your wishes are respected.

There are a number of different ways to document your end-of-life wishes. You can create a living will, a health care proxy, or a durable power of attorney for health care.

A living will is a legal document that states your wishes for end-of-life care. This document can be used to make decisions about such things as whether you want to be kept alive on life support, whether you want to receive pain medication, and whether you want to donate your organs.

A health care proxy is a document that gives someone else the legal authority to make medical decisions on your behalf if you are unable to do so yourself. This document can be used to make decisions about such things as whether to continue life-sustaining treatment, whether to receive blood transfusions, and whether to donate your organs.

A durable power of attorney for health care is a document that gives someone else the legal authority to make health care decisions on your behalf even if you are able to make decisions yourself. This document can be used to make decisions about such things as whether to continue life-sustaining treatment, whether to receive blood transfusions, and whether to donate your organs.

It is important to talk to your loved ones about your end-of-life wishes. This will help them to understand your wishes and to make decisions that are in your best interests.

Planning for your future can be overwhelming, but it is important to start thinking about these things early on. By ng so, you can ensure that you have the necessary resources in place to meet your needs as you age.

4 out of 5

| Language | : | English |

| File size | : | 3647 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 87 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Amy Fazio

Amy Fazio Giselle Wrigley

Giselle Wrigley Amy Myers

Amy Myers American Cancer Society

American Cancer Society Jfk Mensah

Jfk Mensah Amy Sparkes

Amy Sparkes Sandra Lawrence

Sandra Lawrence Judith E Harper

Judith E Harper Amitava Dasgupta

Amitava Dasgupta Ambrose Bierce

Ambrose Bierce Amy Mihaly

Amy Mihaly Ellie O Ryan

Ellie O Ryan Mario Botsch

Mario Botsch Jeffery Weaver

Jeffery Weaver Amy S Hrutkay

Amy S Hrutkay R J Larson

R J Larson James Cowan

James Cowan Mike Bryant

Mike Bryant Stephen Arterburn

Stephen Arterburn Amy Kim

Amy Kim

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Isaac BellExtreme Rapid Weight Loss Hypnosis: Unlock the Power of Your Mind for Lasting...

Isaac BellExtreme Rapid Weight Loss Hypnosis: Unlock the Power of Your Mind for Lasting...

Miguel NelsonFour Cookbooks In One: Recipes To Fight Cancer, Heart Disease, And Build Your...

Miguel NelsonFour Cookbooks In One: Recipes To Fight Cancer, Heart Disease, And Build Your... Ralph Waldo EmersonFollow ·12.7k

Ralph Waldo EmersonFollow ·12.7k Chase MorrisFollow ·16.3k

Chase MorrisFollow ·16.3k Esteban CoxFollow ·6.3k

Esteban CoxFollow ·6.3k Earl WilliamsFollow ·8.8k

Earl WilliamsFollow ·8.8k Chuck MitchellFollow ·5.2k

Chuck MitchellFollow ·5.2k Allen ParkerFollow ·2.2k

Allen ParkerFollow ·2.2k Eric NelsonFollow ·14.4k

Eric NelsonFollow ·14.4k Jerome PowellFollow ·12.9k

Jerome PowellFollow ·12.9k

Miguel Nelson

Miguel NelsonFour Cookbooks In One: Recipes To Fight Cancer, Heart...

Looking for a healthy way...

Marcus Bell

Marcus BellHearts and Souls: Exploring the Lives and Legacies of...

The Special Olympics movement has been a...

Tony Carter

Tony CarterDiagnosed With Breast Cancer: Navigating Life After the...

A breast cancer diagnosis can be a...

Joe Simmons

Joe SimmonsLiddypool: The Stories and Interviews – A Literary...

In the realm of...

Jett Powell

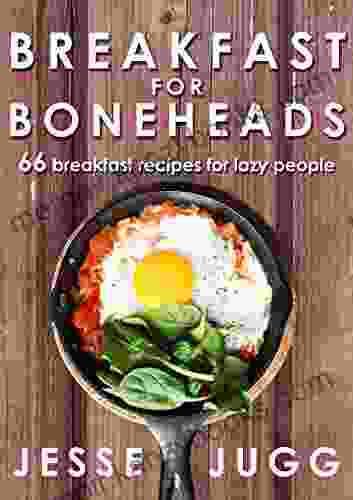

Jett PowellBreakfast for Boneheads: 66 Breakfast Recipes for Lazy...

Are you tired of eating the...

4 out of 5

| Language | : | English |

| File size | : | 3647 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 87 pages |

| Lending | : | Enabled |